Table of Contents

- Retirement age by 2025: how Social Security will change due to COLA

- Social Security Announces 2.5% COLA for 2025; Benefits Struggle to Keep ...

- Social Security: What To Expect in 2025 - Newsweek

- SNAP and Social Security COLA: A Comparison for 2025

- What Is The Maximum Social Security Withholding For 2025 - Alfy Louisa

- Social Security in 2025: What You Need to Know About Benefits and ...

- Five Changes to Social Security in 2025 | Kiplinger

- Navigating the Future of Social Security: A 2025 Perspective | PaySpace ...

- 5.2% Increase to Social Security Maximum Taxable Earnings in 2024 - YouTube

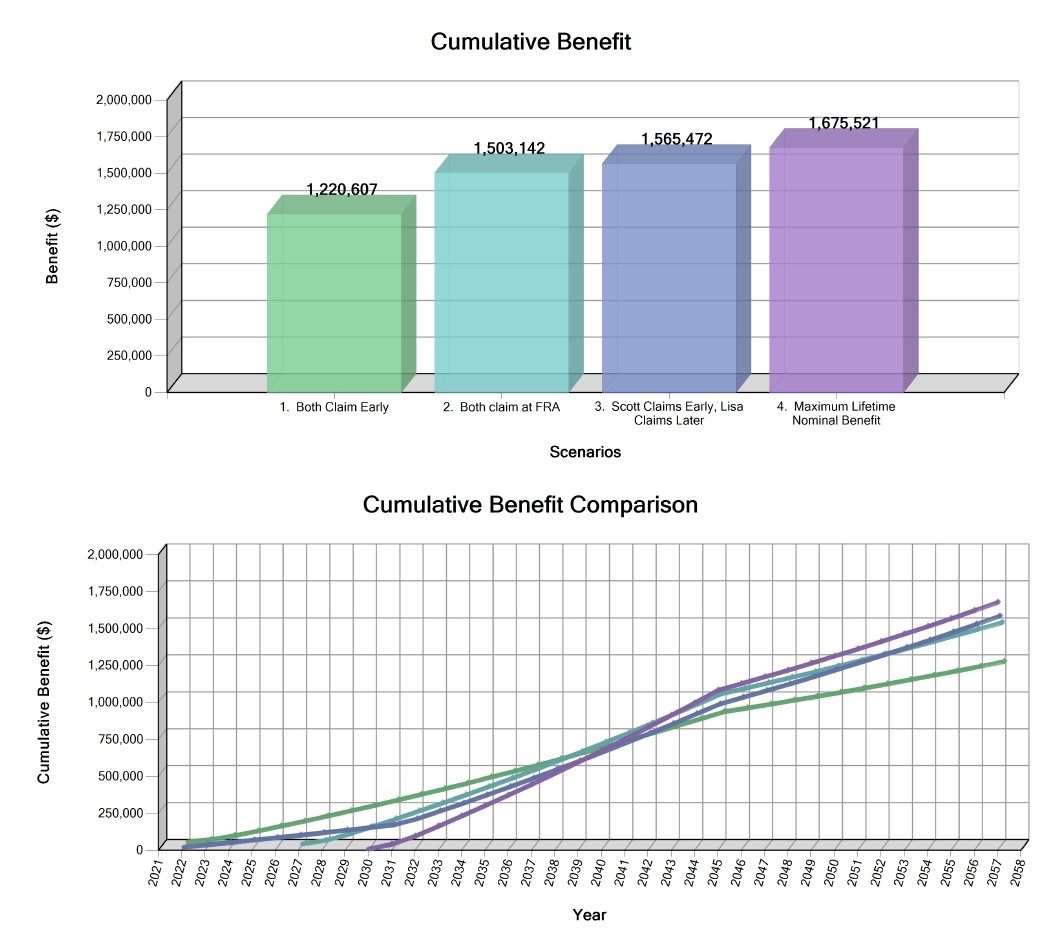

- Social Security Claiming Age: Theoretically Optimal vs. Real World ...

The Social Security taxable income limit is the maximum amount of earnings that can be subject to Social Security taxes. In 2024, this limit is set at $160,200, but for 2025, it will increase to $168,600. This means that any earnings above this threshold will not be subject to Social Security taxes. However, it's essential to note that this change only affects the amount of income that is subject to Social Security taxes, not the amount of benefits you receive.

How Will This Affect Your Taxes?

For example, let's say you earn $200,000 in 2025. In 2024, you would have paid Social Security taxes on $160,200 of that income. However, in 2025, you'll only pay Social Security taxes on $168,600, resulting in a reduction in your Social Security tax liability. This could lead to a lower tax bill, but it's essential to consult with a tax professional to understand the full implications of this change.

What Does This Mean for Your Social Security Benefits?

However, it's essential to note that the Social Security Administration uses a complex formula to calculate benefits, taking into account your 35 highest-earning years. If you're a high-income earner, the increase in the taxable income limit may affect your benefits in the long run, but this will depend on your individual circumstances.

The increase in the Social Security taxable income limit for 2025 is an important update that may impact your taxes. While it's essential to understand the details of this change, it's also crucial to remember that this only affects Social Security taxes, not other types of taxes. If you're concerned about how this change will affect your taxes or benefits, it's always best to consult with a tax professional or financial advisor.Stay informed about the latest updates and changes to Social Security and taxes by following reputable sources, such as the Social Security Administration and MSN. By staying up-to-date, you can make informed decisions about your finances and ensure you're taking advantage of the benefits and tax savings available to you.

Keyword: Social Security, taxable income limit, 2025, taxes, benefits, MSN. Meta Description: The Social Security taxable income limit is increasing in 2025. Learn how this change will affect your taxes and benefits, and what you need to know to stay informed. Header Tags: H1, H2, H3. Image: Social Security card, taxes, benefits, financial planning. Internal Linking: Social Security Administration, MSN, tax professionals, financial advisors. External Linking: Social Security Administration, MSN, tax professionals, financial advisors.