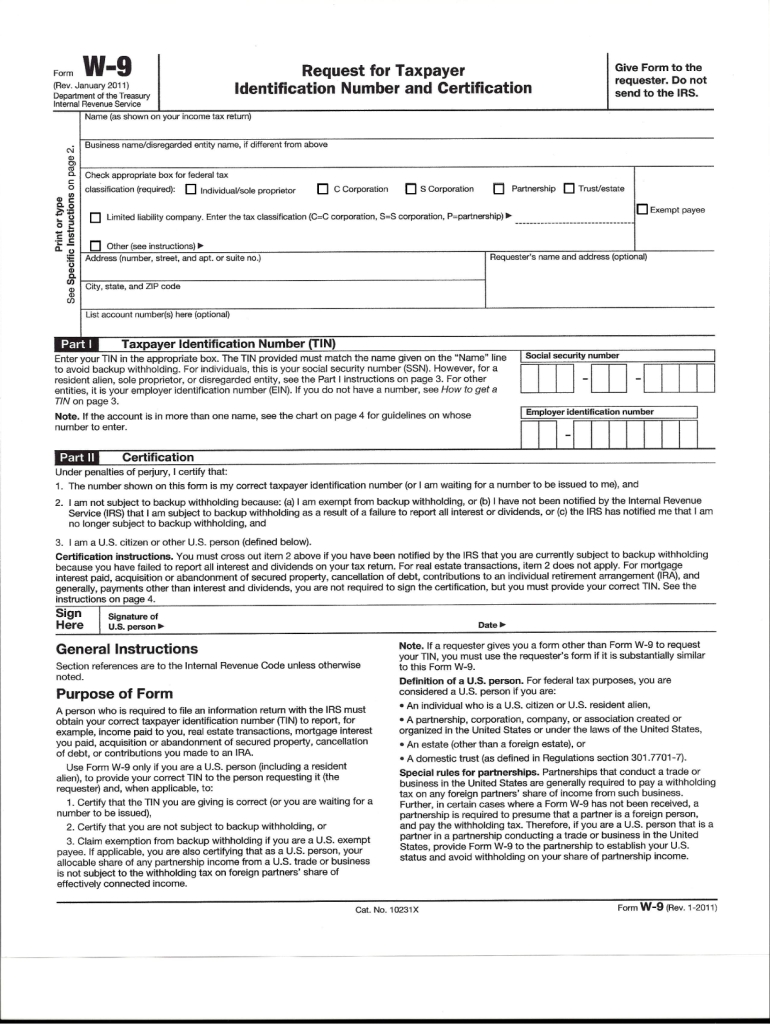

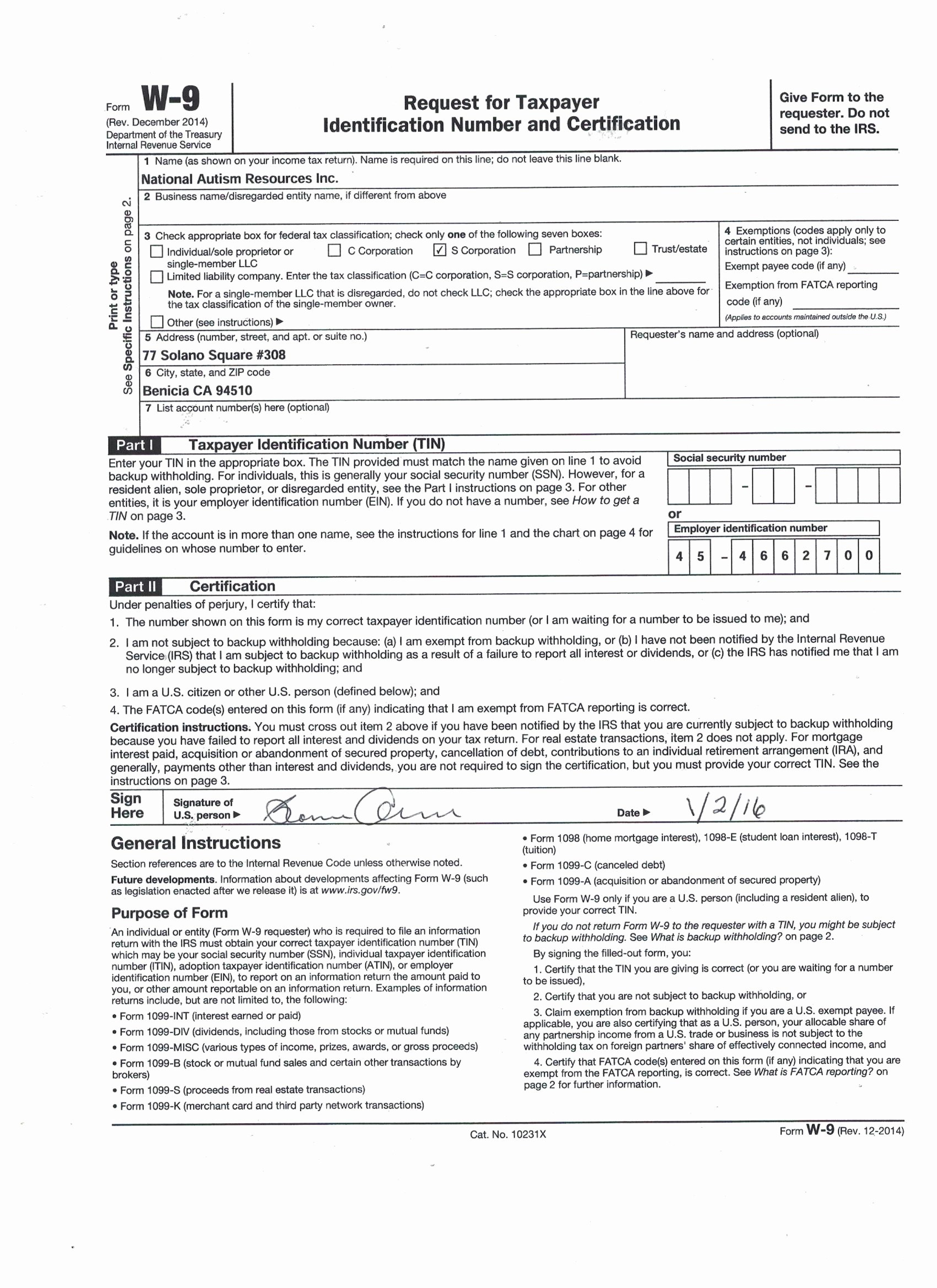

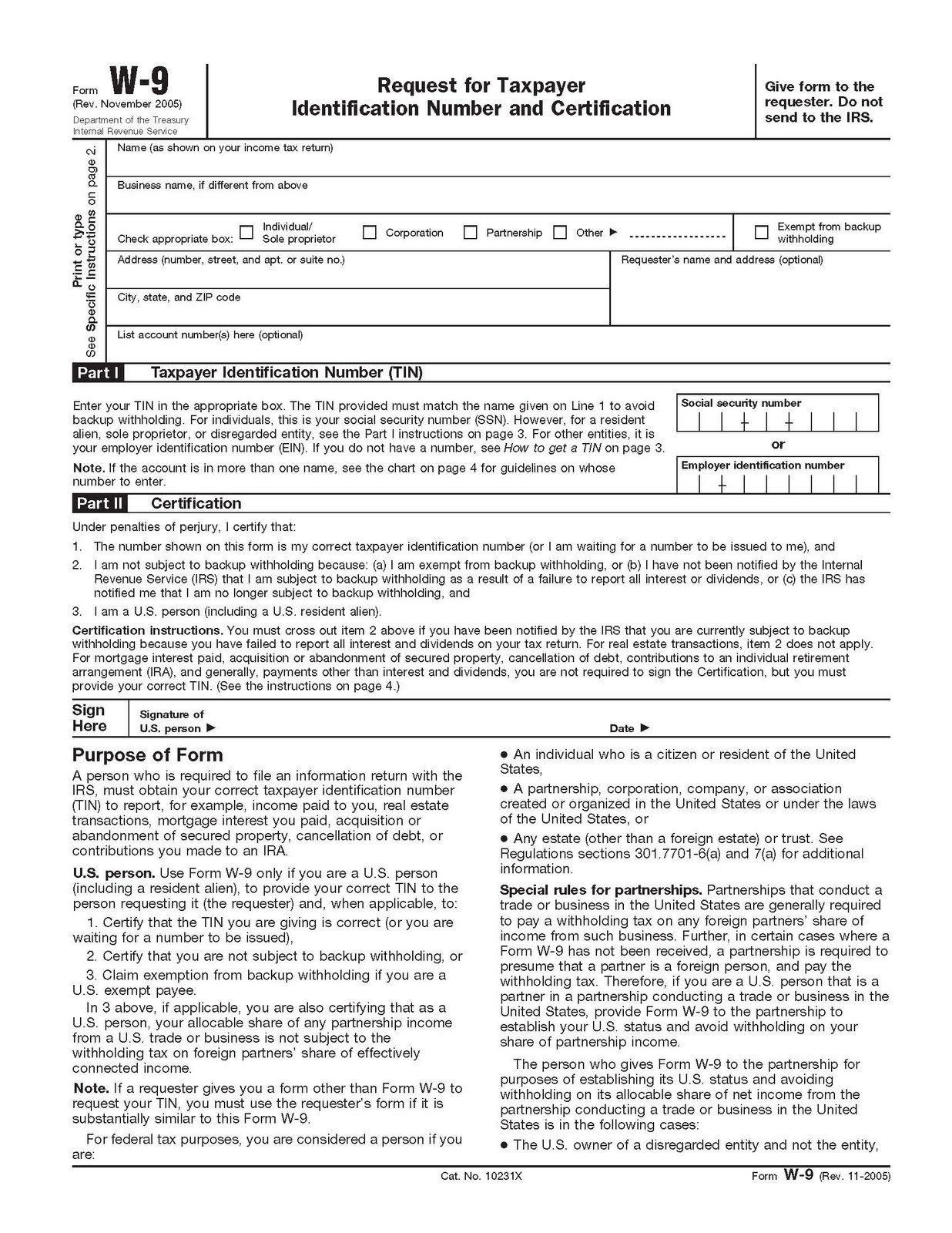

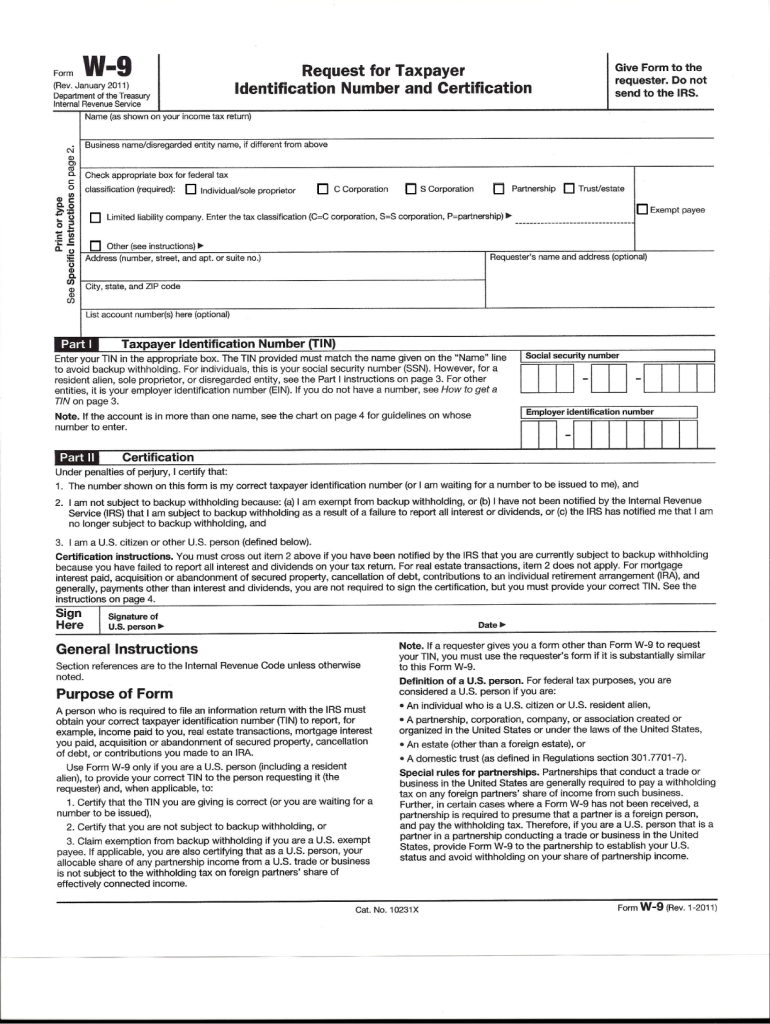

The IRS Form W9, also known as the Request for Taxpayer Identification Number and Certification, is a crucial document used by the Internal Revenue Service (IRS) to collect taxpayer identification information. The

PDF version of this form is widely used by businesses, freelancers, and independent contractors to provide their taxpayer identification number (TIN) to clients, vendors, and other payers. In this article, we will delve into the details of the

PDF IRS Form W9, its purpose, and how to fill it out correctly.

What is the Purpose of the IRS Form W9?

The primary purpose of the IRS Form W9 is to provide a taxpayer identification number (TIN) to payers, which can be either an Employer Identification Number (EIN) or a Social Security Number (SSN). This information is used to report income paid to the taxpayer on information returns, such as the Form 1099-MISC. The form also certifies that the taxpayer is not subject to backup withholding and is eligible to receive payments without tax withholding.

Who Needs to Fill Out the PDF IRS Form W9?

The following individuals and businesses are required to fill out the

PDF IRS Form W9:

Freelancers and independent contractors

Sole proprietors and single-member limited liability companies (LLCs)

Partnerships and multi-member LLCs

Corporations and S corporations

Tax-exempt organizations

How to Fill Out the PDF IRS Form W9

Filling out the

PDF IRS Form W9 is a straightforward process. Here are the steps to follow:

1. Download the

PDF version of the IRS Form W9 from the official IRS website.

2. Fill out the form electronically or print it out and fill it out by hand.

3. Provide your name, business name, and address.

4. Enter your taxpayer identification number (TIN), which can be either an EIN or an SSN.

5. Certify that you are not subject to backup withholding and are eligible to receive payments without tax withholding.

6. Sign and date the form.

Importance of Accuracy and Timeliness

It is essential to fill out the

PDF IRS Form W9 accurately and return it to the payer in a timely manner. Failure to provide a correct TIN or certify your eligibility for tax withholding can result in backup withholding, penalties, and fines.

In conclusion, the

PDF IRS Form W9 is a critical document used by the IRS to collect taxpayer identification information. By understanding the purpose and requirements of this form, individuals and businesses can ensure compliance with IRS regulations and avoid potential penalties. If you are required to fill out the

PDF IRS Form W9, make sure to follow the steps outlined in this article and return the form to the payer in a timely manner.

By following these guidelines and using the

PDF version of the IRS Form W9, you can ensure that your taxpayer identification information is accurate and up-to-date, and that you are in compliance with IRS regulations. Remember to always use the most recent version of the form, which can be found on the official IRS website.